U.S. Solar: Supply Chain, Legislation and the Complex Road Ahead

-

March 03, 2022

DownloadsDownload Article

-

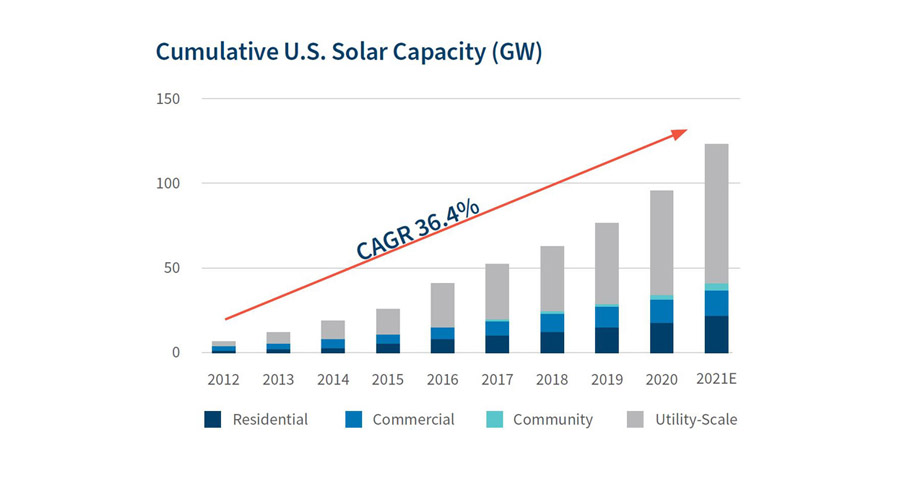

Last year (2021) will shape up to have been another record year for U.S. solar, with Woodmac estimating in December that installed solar capacity for the year will land north of 20 GWdc. Through 3Q21, the U.S. installed 15.7 GWdc of solar and solar represented 54% of new capacity added in the United States year-to-date. However, as a result of mounting solar supply chain constraints and commodity price increases — which are driving a meaningful increase to solar installed costs — Woodmac has lowered its U.S. solar forecast for 2022 by 25% (representing a decline of 7.4 GWdc, the majority of which is in the utility-scale solar segment).

Source: Woodmac; SEIA

However, there are a number of offsetting factors in play, including potential increased renewable energy incentives and an extension of the Investment Tax Credit (ITC) should the Build 100 Back Better Act (BBB) get approved by the Senate. And while U.S. renewable energy industry growth remains robust, including the outlook for M&A activity, supply chain disruptions and trade challenges impacting the U.S. solar market will be key focus areas attracting significant attention as we further progress through 2022 and into 2023.

The U.S. solar industry’s heavy reliance on raw materials and photovoltaic (PV) module components manufacturing from foreign countries – in particular China, in which degrading U.S.-China trade relations are further exacerbating matters – is fueling supply chain disruptions. Polysilicon, the key raw material in upstream solar products, has experienced a 300% price increase since January of 2020. And, according to Bernreuter Research, upwards of 50% and potentially as much as 75% of the world’s polysilicon is currently sourced from China. Furthermore, China dominates the market in upstream solar components manufacturing, in particular ingots, wafers and cells. Further compounding these issues are continued pandemic related disruptions, including logistics and ocean freight costs, the latter of which more than quadrupled in 2021. While we do not anticipate any reductions in demand for solar in the United States, the supply chain and trade issues will continue to create project delays and increased costs for solar project developers.

Strategic Considerations and the Issues Landscape

The increasingly complicated supply chain for solar inputs pits financial and competitive interest against “moral costs” as companies face stakeholder scrutiny. The road ahead will undoubtably be fraught with regulatory exposure and significant reputation risks as the margin for error shrinks both in the United States and in China. Navigating the geopolitical, trade and diplomatic wrangling between the world’s largest two economies presents a challenge and opportunity for operational alignment and risk mitigation for companies in the solar sector and others with significant geographic resource concentration challenges – rare earth minerals and critical components.

The Biden Administration set a target of reducing greenhouse gas emissions by 50%-52% from 2005 levels by 2030. Achieving this target is central to the balance struck between different segments of the solar industry on both sides of the tariff debate, as well as the demands of the labor movement (a key political constituency for President Biden), who see alleged anti-competition tactics from China as a direct threat to onshoring domestic manufacturing jobs. Meeting this aggressive emissions target will require incentivizing domestic production of panels utilizing imported crystalline silicon solar products while seeking duty free import substitutions from Canada and Mexico in the near to medium term.

Case Study: Just weeks after the Uyghur Forced Labor Prevention Act (H.R.6256) was enacted into law, U.S. electric vehicle automaker Tesla announced a new showroom in Xinjiang, setting off alarm bells in Washington, D.C. The action drew the ire of powerful Democratic lawmakers who sent a letter urging the company to align with the U.S. government stance on the status of the region.

Although much is still uncertain (and factors can change quickly), history suggests that the November 2022 mid-term elections could usher in at least a partial change of power in Congress. But that may not mean directional change in the risk calculus for the industry: Republican members in the Senate, for example, have made pushing back on China a central policy priority — in some cases more aggressively than their Democratic colleagues — and are unlikely to retreat from this position.

Political and Policy Environment

On December 23, 2021, President Biden signed into law the Uyghur Forced Labor Prevention Act (UFLPA), H.R. 6256. This legislative authority provides new tools and enforcement mechanisms to prevent goods with a nexus to the Xinjiang workforce from entering the U.S. market.

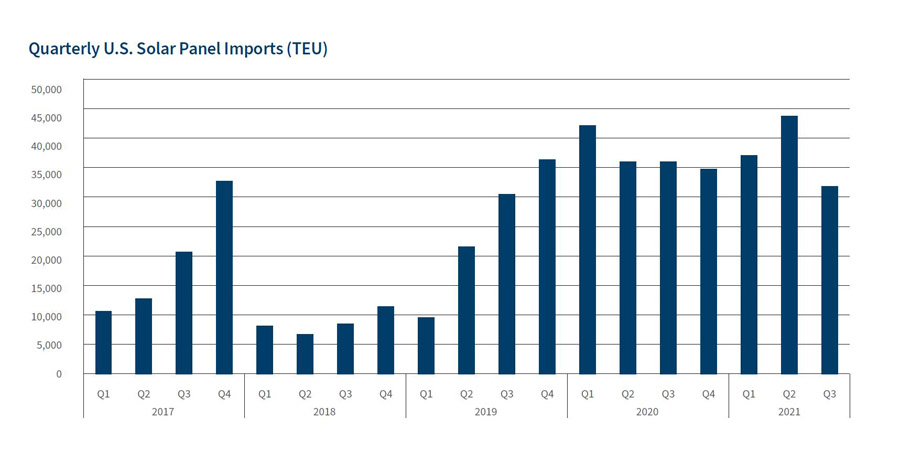

Source: Source: S&P, Panjiva

Under the UFLPA and effective June 21, 2022, U.S. Customs and Border Protection (CBP) will impose a rebuttable presumption1 that all materials sourced from the Xinjiang Uyghur Autonomous Region are associated with the Uyghur workforce and subject to enforcement action at the border. Unless the U.S. importer can provide “clear and convincing”2 evidence that the imported articles were not produced under prohibited labor standards, the goods will be subject to a withhold release order and denied entry into U.S. commerce3.

In addition to the effective blocking of Xinjiang-related imports from U.S. markets, the UFLPA also requires the President to furnish Congress with information on specific businesses and individuals related to prohibited labor actions and to impose sanctions on those parties4.

Presidential Proclamation on Solar Tariffs

On February 4, 2022, President Biden announced an extension and modification of the Trump Administration’s Section 201 solar tariffs that levied a decreasing scale starting at 30% on imported crystalline silicon PV cells (whether or not partially or fully assembled into other products) from certain regions, including China. The proclamation extends the solar tariffs, originally due to expire on February 6, 2022, for another four years, excluding bifacial modules used primarily in utility-scale solar installations. This is viewed as a positive development for companies to help spur growth in American manufacturing especially in the renewable energy sector. The amended proclamation will also move the threshold for the number of solar cells that can be imported duty-free from 2.5 gigawatts to 5 gigawatts. Major industry trade groups have offered qualified praise to the measure, with the Solar Energy Industries Association (SEIA) calling the move a balanced solution and the American Clean Power Association (ACPA) welcoming the decision to extend the Section 201 exclusion for bifacial modules. Several of the nation’s largest solar manufacturers, however, have openly expressed disappointment.

| Legislation | Program | Appropriations |

|---|---|---|

| The America Creating Opportunities for Manufacturing, Pre-Eminence in Technology, and Economic Strength Act of 2022 (America COMPETES Act - H.R. 4521) | Sec. 20302 Solar Component Manufacturing Supply Chain Assistance - lays out the provisions for solar component manufacturing supply chain assistance. It directs the Secretary of Energy to establish a program to award grants and direct loans to eligible entities to carry out projects in the United States for the construction of new solar component manufacturing facilities, and retooling, retrofitting, or expanding of existing facilities to make the United States less reliant on components made in China | The bill authorizes $3 billion, or $600 million a year, from fiscal year 2022 through 2026. |

| Build Back Better – H.R.5376 | The Build Back Better Act includes tax credits that can cut the cost of installing rooftop solar panels by about 30%, shortening the payback period by around five years. Passage of the legislation would represent the single largest clean energy investment in U.S. history. It is unlikely to pass in its entirety; however, sections of the bill will likely find bipartisan support and passed as standalone legislation. | The Act would authorize $325 billion in tax incentive extensions and modifications including extending existing incentives such as the ITC, the production tax credit (PTC), and the Section 45Q carbon capture and sequestration credit. PTC for solar energy would be revived and extended through 2026. Would allow taxpayers to receive “direct payment” in lieu of a tax credit for certain renewable sources including solar |

Trade Considerations

The heavy reliance on Chinese polysilicon and related downstream products will continue to increase wholesale and retail costs for PV solar cells and modules, which is further strained by the U.S. government’s ongoing trade campaign against Chinese-origin imports. It is likely that nearly all U.S. importers of crystalline silicon photovoltaic

(CSPV) solar cells and modules will be impacted by at least one of the four trade actions listed below. While these trade actions do not appear to have diminished domestic demand for CSPV products, the market’s exposure to Chinese dominance of the relevant raw materials and downstream products will require increased regulatory vigilance from importers and increased costs passed on to U.S. consumers.

| Trade Action | Goods Targeted | Monetary Impact |

|---|---|---|

| Section 201 Safeguard Tariffs5 | CSPV cells, parts thereof and downstream finished goods from a majority of exporting countries, including China | 15% ad valorem |

| Section 301 Punitive Tariffs6 | HTSUS subheadings 8541.42 and 8541.43, Chinese-origin PV cells, whether or not assembled into modules or made up into panels | 25% ad valorem |

| Antidumping & Countervailing Duty (ADCVD)7 | ADCVD orders A-570-979 and C-570-980, covering [CSPV] Cells, Whether or Not Assembled into Modules, From the People’s Republic of China | ADCVD duty rates of 238.95% and 18.49%, respectively, ad valorem |

| Withhold Release Order8 | Silica-based products produced by Hoshine Silicon Industry Co., Ltd (Hoshine) and its subsidiaries | Closes the U.S. market to any silica-based articles with suspected ties to Hoshine |

Re-evaluating Solar Supply Chain Strategies

Explosive growth during the COVID-19 era has triggered the need to re-evaluate key solar supply chain strategies including cost and lead-time in order to gain supply chain efficiencies and to control costs. According to the World Economic Forum, approximately 56% of worldwide utility-scale solar projects planned for 2022 could be postponed or cancelled due to supply chain disruptions, including rising shipping and increased solar panel component costs9. The impacts of COVID-19 outbreaks on ports and factories in China seems like a pandemic-induced problem, but a supply chain system less reliant on Chinese production could absorb those shocks more effectively.

While it is no easy task to shift manufacturing operations, in particular due to the volume of infrastructure and capacity in China, the disruption created by COVID-19 has served as a wake-up call for market participants and sent shock waves throughout global supply chains to diversify geographic concentration risk. Constraints such as port congestion, freight rates and tariffs have forced management teams to acknowledge the need to invest in their supply chain to optimize lead time, cost and inventory management, while prioritizing savings opportunities. One supply chain strategy we are seeing utilized more frequently is “nearshoring,” which occurs in multiple phases as illustrated in the table below:

| Nearshoring Phases | |

|---|---|

| Phase 1 | Assembly/Manufacturing in North America, but reliance on China/Asia-centric suppliers |

| Phase 2 | Develop and stand up North America component suppliers to mitigate supply chain risk and reduce upstream lead times |

Some of our clients are taking a hard look at spreading supply chain risk so that it is not so China-centric or even Asia-centric. For example: one of our clients, an industry leader in the solar and energy industry, encountered significant supply chain and manufacturing constraints.

Products were manufactured in China and shipped to North America for sale to customers, but, due to recent supply chain constraints and unpredictability in ocean freight rates, the client projected substantial financial losses.

Working in lockstep with our client, we assessed the feasibility and impact of shifting manufacturing operations to North America (“nearshoring”), which consisted of extensive negotiations with contract manufacturers, evaluating tariff impacts and financial modeling. Our client ultimately concluded that shifting manufacturing to North America was in the best interest of the company, resulting in significant supply chain efficiencies, manufacturing predictability and cost savings.

As companies continue to operate during and after the COVID-19 era, we are seeing increased scrutiny on supply chains and are advising leadership teams take a deeper look into the sustainability of their manufacturing footprint. Geographic concentration risk is more prevalent than ever in today’s supply chain, and, while we cannot be certain about upcoming legislative decisions, the need to diversify supply chain risk is a top priority in the COVID-19 era.

How FTI Consulting Can Help

FTI Consulting assists companies facing increased scrutiny from CBP as a result of supply chain challenges related to tariffs and admissibility. Our team has extensive experience in tracing the origin of imported products, evaluating opportunities to mitigate tariff impacts, and quantifying duty costs of alternative sourcing plans. We apply the latest regulatory precedent to determine the step in the manufacturing process most likely to confer origin, then can evaluate whether imported goods have been impacted by an impermissible workforce. For clients with grounds to demonstrate admissibility, FTI Consulting guides them through communications with the U.S. government, such as facilitating discussions to detail acceptable manufacturing activities or preparing administrative filings to dispute unjustified punitive duties, detentions or exclusions.

FTI Consulting couples operational experience with leading industry experts who understand global supply chains. Our team advises clients on supply chain issues such as: Planning, Strategic Sourcing & Procurement, Manufacturing, Transportation & Logistics, Nearshoring Operations, Footprint Optimization and Supply Chain Risk & Resiliency.

FTI Consulting takes a holistic, integrated approach to identifying and managing sourcing risks and supply markets. We review all product subcategories and cross reference them with market intelligence to prioritize opportunities. By identifying cost take-out opportunities in areas of indirect and direct expenses, FTI can help capture savings to offset potential price increases caused by market conditions, such as those affecting polysilicon. FTI also supports companies in communicating these risk management strategies and addressing concerns with investors, customers, and policymakers. From project-level to enterprise-wide efforts, our team of experts assesses and identifies stakeholder concerns, helping clients maintain control of the narrative.

Footnotes:

1: See H.R. 6256, Section 3: “REBUTTABLE PRESUMPTION THAT IMPORT PROHIBITION APPLIES TO GOODS MINED, PRODUCED, OR MANUFACTURED IN THE XINJIANG UYGHUR AUTONOMOUS REGION OR BY CERTAIN ENTITIES.” Pages 5-6.

2: Id., page 5.

3: Id., page 6.

4: See H.R. 6256, Section 5: “IMPOSITION OF SANCTIONS RELATING TO FORCED LABOR IN THE XINJIANG UYGHUR AUTONOMOUS REGION.” Page 5.

5: 83 FR 3541: “To Facilitate Positive Adjustment to Competition From Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into Other Products) and for Other Purposes.”

6: 83 FR 40823 - 40838: “Notice of Action Pursuant to Section 301: China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation.”

7: 77 FR 63791-63798: “Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules, from the People’s Republic of China: Final Determination of Sales at Less Than Fair Value, and Affirmative Final Determination of Critical Circumstances, in Part.”

8: “The Department of Homeland Security Issues Withhold Release Order on Silica-Based Products Made by Forced Labor in Xinjiang.” U.S. Customs and Border Protection, June 24, 2021.

9: Nicolas Rivero, “Here’s how supply chain issues are affecting renewable energy projects,” World Economic Forum (November 4, 2021), https://www. weforum.org/agenda/2021/11/supply-chain-problems-solar-power-renewable-energy/.

5: 83 FR 3541: “To Facilitate Positive Adjustment to Competition From Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into Other Products) and for Other Purposes.”

6: 83 FR 40823 - 40838: “Notice of Action Pursuant to Section 301: China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation.”

7: 77 FR 63791-63798: “Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules, from the People’s Republic of China: Final Determination of Sales at Less Than Fair Value, and Affirmative Final Determination of Critical Circumstances, in Part.”

8: “The Department of Homeland Security Issues Withhold Release Order on Silica-Based Products Made by Forced Labor in Xinjiang.” U.S. Customs and Border Protection, June 24, 2021.

9: Nicolas Rivero, “Here’s how supply chain issues are affecting renewable energy projects,” World Economic Forum (November 4, 2021), https://www. weforum.org/agenda/2021/11/supply-chain-problems-solar-power-renewable-energy/.

Published

March 03, 2022

Key Contacts

Key Contacts

Senior Managing Director, Leader of Power, Renewables & Utilities practice

Senior Managing Director

Senior Managing Director